Public act 345 millage proposals information

The City of Wayne is placing two ballot proposals before the City’s electors that would give the option of creating a police and fire retirement system pursuant to Public Act 345 of 1937.

Why is the city asking

for this millage?

At the peak of the 2008 national recession, city employees were offered a higher pension if they retired early. Due to the influx of new retirees into the system, long-term investment returns being less than anticipated, extended life expectancies, and other reasons, the unfunded pension obligation has risen significantly in the last 14 years. For example, the annual required contribution to the Municipal Employees’ Retirement System (MERS), rose from $1.8 million in 2010 to $7.8 million in 2022 (see graph below). During this same time, the city lost nearly 45% of its tax base and has not fully recovered since. Primarily due to these reasons, rising pension costs, reduction to property taxes, and the state withholding billions of dollars in revenue sharing that rightly belongs to the cities, the city has found itself in a position that it cannot afford to pay 100 percent of the required pension contribution. In Michigan, making the required pension contribution is not a choice, but an obligation mandated by state law. The city has continued to do everything possible to avoid this millage. Properties have been sold, staffing is still at a minimum, the employees took concessions in their contracts, retiree healthcare has been reduced to a monthly stipend, and the city has reduced spending across the board significantly. Despite these efforts and sacrifices, there is no other option to avoid the current situation. In 2020, the MERS System sued the City of Wayne for not meeting the pension obligation due to budget constraints which equated to a 13.1399 mill levy on the winter taxes. It is the city’s hope that another judgement levy will not be necessary in the future if the PA345 proposals are approved by the electors.

What is Public Act 345?

What is Public Act 345?

AN ACT to provide for the establishment, maintenance, and administration of a system of pensions and retirements for the benefit of the personnel of fire and police departments employed by cities, villages, or municipalities having full paid members in the departments.

What is being proposed

to the city’s electors?

The two proposals will be on the Tuesday, November 8, 2022, General Election ballot, and will propose the following amendments to sections 19.1 and 19.3 of Chapter 19 of the Wayne City Charter:

Proposal NO. 1

Shall Chapter 19 of the Charter of the City of Wayne be amended so that police officers and firefighters are excluded from the retirement system established by the City Charter, effective with the 2023-2024 fiscal year, and instead become members of a separate retirement system under 1937 PA 345, as amended, and that accumulated contributions to the current employee’s retirement system made by or on behalf of such officers be transferred to the Act 345 retirement system? This charter amendment shall not be effective unless the electors approve the establishment of a separate retirement system under said Act 345.

Proposal NO. 2

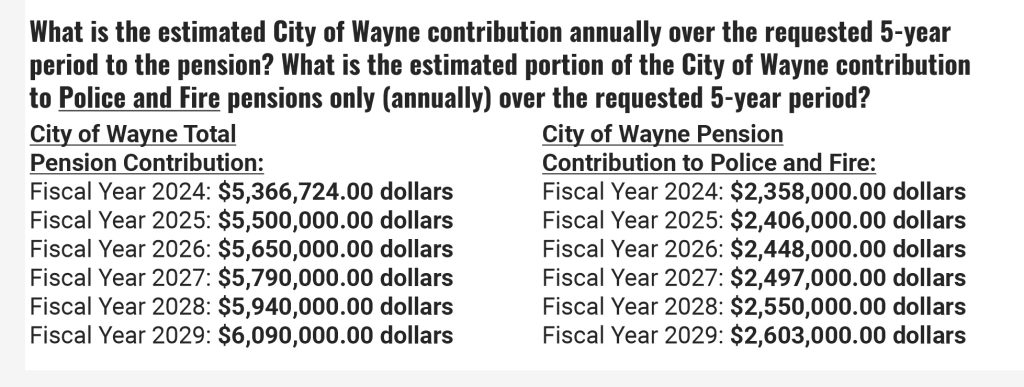

Shall the City of Wayne, Wayne County, Michigan, be authorized to establish a separate retirement system pursuant to Act 345 of 1937, as amended, for the benefit of police officers and firefighters employed by the City, create a board of trustees to manage and operate the system, and be authorized to levy a new tax annually in an amount sufficient to fund the system in an actuarially sound manner, but not to exceed 8.00 mills in any year on each dollar ($8.00 per $1,000) of taxable value of all property in the City, for a period of 5 years, all contingent upon the approval by the electors of a City Charter amendment authorizing the transfer of police officer and firefighter members from the current employee’s retirement system to the new system created under Act 345? It is expected that approximately 8 mills will be levied in 2023 and will raise the sum of approximately $3,266,160.00.

(The Public Act 345 Board membership is governed by MCL 38.551 and consists of: (1) Treasurer; (1) Fire Department Member; (1) Police Department Member; (2) Additional members appointed by the legislative body or another person or body authorized by the city charter to appoint administrative officials in any city affected by the provisions of the act.)

To go into effect, both proposals must pass.

If both proposals pass, the City Council has the ability annually, to determine how many mills (up to 8) will be needed to ensure that the pension payment obligations are met for police and fire. That means, the City Council can make the determination to collect anywhere from 0-8 mills, depending on whether there is a gap in funding. This option will be available to the City Council for a period of 5 years beginning in 2024. The millage would be collected on the winter 2023 taxes. Any millage funding that is collected can only be used for police and fire pension payments and cannot be used in any other manner.